The investment arm of Ethereum tools developer ConsenSys, whose product list includes MetaMask and Infura, has stakes in Coinhouse, Matter Labs, and Canza Finance. With a focus on “the global transition to decentralized technology,” this thesis-driven VC firm holds investments in DeFi protocols like Fei, Rari, and Zapper. Relevant Content: Top Crypto PR Agencies in 2022 Framework Ventures Draper VCįounded in 1985 by Tim Draper as Draper Associates and then turned into a VC firm, they have positions in Bancor, MakerDAO, and Tezos, as well as Coinbase, Ledger, Bitwage, and CryptoMove. Pantera has been investing in blockchain-based solutions since 2013 and boasts stakes in Coinbase, FTX, Polkadot, and others. Its portfolio covers Audius, Arweave, and Near Protocol. This “thesis-driven investment firm” is a crypto-native fund that participates in staking, liquidations, and other crypto operations. This VC’s most notable investments are in Acala, Celo, and dYdX. Polychainįounded by Olaf Carson-Wee, who started as the head of risk and product manager at Coinbase, Polychain is one of the most significant crypto-based investments. Sequoia CapitalĪnother traditional VC fund, Sequoia, recently started investing in blockchain-based companies, their most famous being Robinhood, Polychain Capital, and Band Protocol. In May 2022, it broke records by raising a $4.5 billion fund dedicated to crypto.

This VC giant was founded in 2009 by Marc Andreessen, and Ben Horowitz has been investing in the crypto sector for over five years now, covering Coinbase, Celo, MakerDAO, and others. Relevant Content: Top Crypto TikTok Accounts Andreessen Horowitz (a16z) Late in 2021, the firm announced the industry’s largest fund at the time at $2.5 billion. Paradigmįounded by Coinbase co-founder Fred Ehrsam and Sequoia Capital partner Matt Huang, Paradigm counts Argent, Optimism, and OpenSea among its portfolio. In June 2022, it closed a $500 million fund to boost Blockchain, Web3.0, DeFi, NFTs, gaming, social, Metaverse, and more. This one is the investment arm of leading crypto exchange Binance that leverages its DEX to invest in projects and has stakes in Terra, Moonbeam, and Coin98, among others.

The crypto-based investment arm of traditional proprietary trading firm Jump Trading has offices in North America, Europe, and Asia and investments in the likes of Solana, Terra, Wormhole, and Fantom.

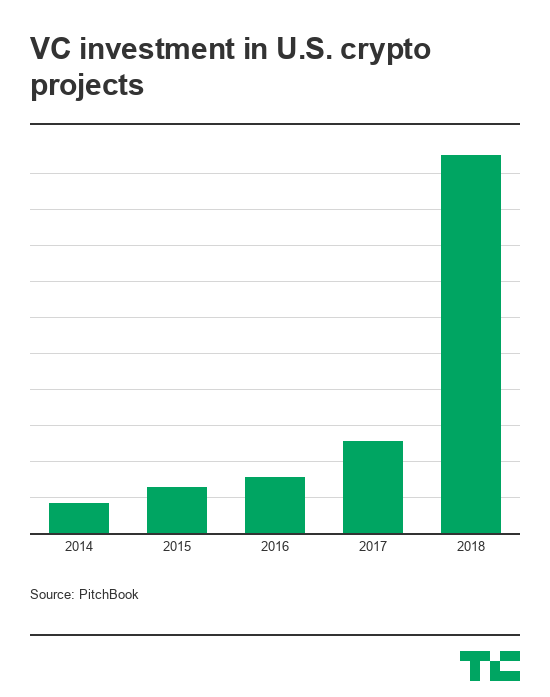

Now, let’s check out some of the notable VC funds in the cryptocurrency industry that are investing in the future: Jump Crypto Increased risk appetite and loose monetary policy led crypto startups to receive $25.2 billion in 2021 compared to just $3.1 billion the year before, according to a CB Insights report.Īdditionally, over 1,000 blockchain deals were executed in the year, surpassing 2020’s level of 662.Īccording to a separate report from Galaxy Digital Research, VCs still invested over $10 billion in crypto startups during Q1 of 2022 despite the downturn in the broad market.Īnd while total VC funding in the crypto space fell from nearly $7 billion in April to just over $4 billion in May, it’s significantly higher than $2.2 billion a year ago in May 2021, according to Dove Metrics data. So, what are the top crypto VC funds to take notice of in 20? VC Funds in the Last Year This led to more activity in the world of venture capitalism.

#Crypto vc jobs how to#

How to Set Up an NFT Discord Server GuideĢ021 was a stellar year for crypto venture capital (VC) funding.Ultimate Cryptocurrency Marketing Guide.

0 kommentar(er)

0 kommentar(er)